July 2022

INVESTMENT OVERVIEW

The second quarter of 2022 was a brutal one for stocks, bonds and most asset classes. It was bad quarter for the market, the economy and turned into the worst first half of the year for stocks since 1970 (Source: CNBC). The freefall in the prices of stocks, bonds, crypto currencies, gold, and other asset classes was the result of investor panic over the economy, the Federal Reserve raising interest rates at the fastest pace in U.S. history in an attempt to slow the economy and high inflation. International scares in China and Ukraine are contributing to anxiety. The global supply chain is still only partially functional as the global economy has been battling issues such as tariffs and lingering pandemic problems. U.S. stocks went through the longest weekly losing streak in market history during the second quarter – 13 straight weeks of declining prices. And according to the American Association of Individual Investors weekly surveys, investors were the most negative about the state of the market and economy since the surveys started in 1987. So, there was lots of economic bad news to deal with and unfortunately investors dealt with the news by selling…just about everything.

All this doesn’t create an optimistic atmosphere for investors and that’s what happens during historically bad selloffs – investors feel bad about the future of the economy, leading to panic selling and quick losses of value in almost every investable asset class. This writer has seen selloffs of similar magnitude during 2008 and 2009 and shorter moments during the trade war in 2019 and the Covid lockdowns during 2020. But automated trading systems now make up the vast majority of trades, so trading volumes are historically high and markets are more volatile than during past market crashes. It’s during these historically bad selloffs, when investors’ moods are as bad as ever and volatility is extremely high, that the best investment opportunities present themselves.

Because stock markets are leading indicators, stock markets nearly always bottom long before the economic news gets better, and the economy begins to recover. The Great Recession was a typical example. The stock market bottomed on March 10th 2009 and began a dramatic rise that saw the First Trust Internet Index ETF (FDN) and the Tech-Software sector index ETF (IGV) rise 165% and 109%, respectively in 2 years until April, 2011 (Source: Yahoo Finance). The explosive rise in these growth sectors of the market didn’t match what was happening in the economy as the unemployment rate stayed near 10% through 2011 and investor confidence remained very low for several more years. The reason the stock charts of these sectors didn’t match the real economy is because investors expected significant continued growth for the tech sector and fast-growing companies for future years, hence markets being forward looking.

Source: Yahoo Finance

The current situation is completely different from the 2009 recession though. Although the U.S. is technically in a recession after 2 consecutive quarters of negative GDP growth, meeting the common definition of a recession, credit quality is better, we’re not having a lending/housing crisis and banks are better capitalized and have far less risky loan portfolios. Unemployment is also historically low, making this recession a strange one. Investor confidence is still very poor, because investors have anticipated that dramatic increases in inflation and interest rates may stick around for a long time. But the economy is clearly better off than in 2009 and the interest rate increases seem to be having the Fed’s desired effect as there are now signs that inflation has peaked and is receding.

As we’ve seen at the end of July, whether inflation has peaked or not is now the top priority on investors’ minds. The U.S. stock market bottomed on June 16th, in anticipation that inflation is starting to come down and that the Federal Reserve would see that and either slow interest rate increases or stop them altogether. Rising interest rates is always bad for the stock market, but any hint that the Federal Reserve might stop or slow rate increases can lead to explosive market moves higher and that is the scenario currently playing out. The tech sector, which saw its worst value declines on record from November 2021 to June 16th 2022, has rallied extremely fast from the bottom. This isn’t unusual, as sharp market rallies are what happened in 2009 and after nearly every market bottom in recent decades.

The internet stock index ETF (FDN) and the Tech-Software sector ETF (IGV) have riven 18% and 17.2% since June 16th, outpacing the S&P 500 Index, which has risen 11% over the same period. If historical market rebound trends hold, the internet and tech stock sectors should again outperform the S&P 500 Index and the broader markets during the market recovery. There’s no way to know if the bottom is truly in, but fantastic companies with huge, expected growth are now selling at multi-year low valuations so this is an obvious buying opportunity in our opinion. By the time the market bottomed, more than 60% of Nasdaq Index stocks had declined 60% or more from their 2021 highs (Source: Bloomberg). On valuation alone, there are some opportunities to buy into great companies at low prices and great companies don’t remain cheap for long.

We have kept our investment strategies intact during this selloff and we’ve made almost no changes since the bear market started in November. There are several reasons why we’ve stuck to our guns with the existing portfolios. We are invested in fantastic companies and sector ETFs. The companies we’re invested in and the areas of the market we put our focus on are assets we want to remain invested in for many years. Our Blended Equity, Global Equity and U.S. Equity strategies hold individual stocks that we want to own for years. These companies are in areas of the economy expected to grow at the fastest rates, such as artificial intelligence, robotics, electric vehicle technology, automation, cybersecurity, business development software and the work-from-anywhere trend. Most of the companies are doing fantastic and even with those that experienced a slowdown due to the recession, we expect those companies’ revenues and earnings to rebound when the economy rebounds too. It’s during market panics like 2022 when the best investors retest the thesis for their investments and if that thesis is still valid, remain patient and wait out the panicked selling.

Going forward, new economic data is definitely showing that inflation is getting under control. The Federal Reserve’s blunt instrument of extreme rate increases is dramatically slowing the economy and therefore many of the indicators of high inflation, such as oil, housing, and food prices are coming down. The Federal Reserve will likely reach their target interest rate in the next few months and either stop or dramatically slow the increases. As inflation declines and gets to a more normal range, economic activity is likely to pick up again. We expect the stock market to rise during this time and we expect that the areas of the market that have been hit the hardest by panicked selling – growth and tech stocks – to outperform other market sectors.

There are plenty of wildcards and unknowns for investors to worry about, but even a worried public can experience very strong market returns. The supply chain issues that still haunt most of the world’s corporations will likely get better as production increases as the world recovers from Covid. Xi Jinping’s obsession with China’s zero Covid policy still likely means periodic shutdowns in the world’s largest cities and manufacturing centers, and this could be a long-term challenge for supply chains. Vladimir Putin’s horrifying invasion of Ukraine has caused significant problems for the global economy, food supply and for the economy of Europe. This is another gigantic unknown, but Russia’s economy has suffered extensively because of the global unification against the unjustified invasion and there’s evidence that the Russian army is having problems continuing the invasion. The best hope is that Russia’s problems with fielding an army and paying for weapons and supplies for the invasion, leads them to declare victory of some sort and stop the fighting.

Looking out several years from now, we expect the strategies our clients are invested in to provide strong performance. But markets are clearly structurally different now with automated trading systems, extreme volatility and huge trading volumes. These risks will lead us toward more diversification in the future and less of a focus on individual stocks in favor of diversified ETFs. Rising interest rates also means bonds should likely play a greater role in clients’ portfolios over the next 5 to 10 years. Bonds now offer healthy yields for the first time in nearly 2 decades and the historic crash in the bond market has led to much lower bond valuations.

Stock Highlights

ETF Overview: Invesco’s QQQ ETF is rated as the best performing large cap growth fund based on total return over the past 15 years, according to Lipper, as of June 30th, 2022. QQQ is the second most traded ETF in the U.S. and the ETF tracks the performance of the Nasdaq 100. Known as a “Growth ETF” that tracks the performance of the largest, most innovative companies in the world, QQQ stands alone as the most well known and most heavily invested growth stock ETF. The ETF is known to be heavily allocated to fast growing U.S. companies in a variety of industries included augmented reality, cloud computing, big data, mobile payments, streaming services, electric vehicles and more.

Financial Highlights: QQQ boasts a fantastic long term performance record, providing annualized returns of 18.47% for the last 10 years and 14.81% over the last 15 (source: Morningstar). QQQ is often thought of as a proxy for growth stocks and/or tech stocks in general because of its size, long-term track record and its heavily allocations to the largest tech giants in the world. The fund’s largest allocations are to Apple, Microsoft, Amazon, Google parent Alphabet, Tesla and others. These 5 giants make up about 43% of the fund’s value. The fund is allocated about 51% to the Information Technology sector and the index the fund tracks, the Nasdaq 100, is the preeminent listing place for the world’s biggest and most innovative tech companies.

Investment Thesis: QQQ has long outperformed many of other older, better known stock market proxies such as the Dow Jones Industrial Average and the S&P 500 Index. Even after declining 35% from the market peak to the bottom this year, QQQ has gained 968.87% cumulatively from the March 10th, 2009 market bottom to now. During this same period, the internet stock index ETF (FDN), which we use in our Conservative Growth strategy, and the Tech-Software sector ETF (IGV) returned 912.27% and 853.64%, respectively. Over this same period the S&P 500 Index gained 427.31% and the Dow Jones Industrial Average gained 338.13%. The outperformance of the Nasdaq 100 and the tech subsectors is primarily due to high allocations to fast growing tech innovators. Although the S&P 500 has underperformed tech, it’s important to note that the senior index has had far less market volatility during the period from 2009 to now.

ETF Overview: This ETF tracks the investment results of an index composed of American companies in the software industry and select stocks in the communications services, interactive media and other technology sectors. The fund offers a way to invest in the growth of the software sector with far less single stock risk. The fund is heavily invested in large, dominant software companies like Microsoft, Adobe, Intuit, Salesforce.com, Oracle and emerging software leaders. The ETF also has extremely high ESG scores and is completely divested from the weapons, tobacco and fossil fuel industries.

Financial Highlights: IGV has provided outstanding long-term performance with annualized returns of 13.12% over the last 15 years. IGV has outperformed the S&P 500 Index in 9 of the last 15 years, but the fund has had larger drawdowns and volatility. 2022 is the 3rd worst performing year for the IGV ETF and we feel this provides a buying opportunity. The fund’s heavy allocation to some of the fastest growing publicly traded companies offers potentially high returns, offset by higher volatility than the rest of the market. With an expense ratio of just 0.4%, we think the IGV fund offers a low cost way to invest in the growth of the software sector.

Investment Thesis: The growth of the software sector has been phenomenal the last 10 to 15 years and we think that growth rate will continue. Software companies often have desirable business models with recurring revenue streams, low capital expenditure costs, predictable cash flows and high profit margins. Software is increasingly necessary in a world where technology is driving innovation in every industry. The businesses found in IGV tend to be non-cyclical, consistent growth companies and have exposure to the fastest growing parts of the global economy. IGV should be a long-term holding for several of our investment strategies.

Disclaimer/Disclosure

The purpose of this newsletter is to explain what is happening with our investment strategies and our current views on the markets. We do not sell our investment report and it is intended only as a communication device. The information in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance or guarantee that the securities discussed herein will remain in an account’s portfolio at the time this report is received. The securities discussed do not represent an account’s entire portfolio and may only represent a small percentage of an account’s portfolio. It should not be assumed that any of the securities discussed were or will prove to be profitable, or that the investment recommendations or decisions ECM makes in the future will be profitable or will equal the investment performance of the securities discussed herein.

ECM uses certain proprietary databases, formulas and devices in its investment decision process. The use of these devices does not change the possibility of loss inherent in all investment decisions.

Contact Us

For questions regarding fees, risks, or other questions, please visit our website at www.ebertcapital.com or contact us directly and we will be happy to assist you.

Ebert Capital Management Inc.

530 F Street

Eureka, CA 95501

Telephone: (707) 407-3813

Toll-free Fax: (855) 407-3815

Email: info@ebertcapital.com

Ebert Capital Management Inc. (ECM) is an independent, fee-only registered investment adviser. Ebert Capital Management claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Ebert Capital Management has been independently verified for the periods Dec 1, 2010 through December 31, 2019. The verification report is available upon request. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. Verification does not provide assurance on the accuracy of any specific performance report.

GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Policies for valuing portfolios, calculating performance, preparing GIPS Reports, and a list of composite descriptions are available upon request.

Past performance does not guarantee future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Past performance of markets, strategies, composites, or any individual securities is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s portfolio. Investment in the above referenced model composite is subject to investment risks, including, without limitation: market risk, interest rate risk, management style risk, business risk, sector risk, and other risks related to equity securities. There are no assurances that a portfolio will match or outperform any particular benchmark. Historical performance results for benchmarks, such as investment indices and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, which would have the effect of decreasing historical performance results.

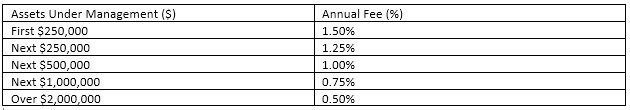

Standard Tiered Fee Schedule for all composites.