October 2021

Investment Overview

Volatility in global stock and bond markets, which have been relatively tame the last few months, roared back in September as the S&P 500 Index saw its largest monthly decline since March 2020. September, for whatever reason, is often a negative month for global stock markets and this time some political and regulatory worries lead investors to sell stocks and bonds. Also, inflation scares from fast rising commodity and product prices has investors worried that the inflationary pressures might not be as temporary as the U.S. Federal Reserve believes. Despite the fact that more than 50% of the S&P 500 Index is in a bear market (a decline of 20% or more), we are confident about the future of the U.S. economy, stock market and our proprietary portfolios.

Market sentiment declined for a variety of reasons in September. A large real estate company in China named Evergrande nearly defaulted on their debt causing fears that that would impact U.S. businesses – but that risk seems small and unrelated to our portfolios. China is also experiencing a growth slowdown with their economy, in addition to turmoil caused by the crackdown on Chinese corporations by Xi Jinping. The fact that Xi, a dictator posing as a legitimately elected leader, can shut down corporate activity at a whim underscores one of the many reasons we don’t invest in Chinese companies.

In the U.S., gridlock in Washington DC is also causing worries among investors because politicians have been unable to handle some of their most basic governing tasks such as raising the debt limit, not defaulting on our debt and not shutting down the government. Congress last week passed a stopgap bill to keep the government open until December 3rd. This delay will allow Congress to focus on raising the debt limit and consider President Biden’s multi-trillion dollar infrastructure plan. While investor worry about these things is logical, we don’t see any of these individual items as long-term investment risks that we will consider with our portfolio decisions and we don’t believe any of these issues matter to the long-term retirement plans of our clients.

Part of Biden’s infrastructure plan calls for tax increases on the very wealthy and some other “modest” changes to the tax code to fund the infrastructure plan. Tax increases on the wealthiest Americans rarely happens in large part because the wealthy are also the biggest lobbyists and U.S. politicians are especially beholden to their interests. And some of the “modest” tax proposals include a capital gains tax rate hike to nearly 40%. This seems like an extreme proposal that would affect many non “uber-wealthy” Americans and this element seems especially unpopular and unlikely to pass through both halls of Congress. Without funding the infrastructure plan with tax increases the President’s plan would need, the plan seems likely to shrink to around $1 trillion or face low prospects of passing into law.

Finally, Federal Reserve Chair Jerome Powell recently testified that the central bank would begin tapering some of its bond purchases soon as the Fed looks to reduce some of the historic monetary support it’s lent to the U.S. economy and markets. The Fed tapering likely means that long-term interest rates will begin to modestly increase from the near all-time lows that rates currently sit at. Rising interest rates can sometimes cause a slowdown in stock market growth, but even this worry doesn’t change our thesis for how we manage our investment strategies nor does this modest increase affect our expectations for our clients’ retirement portfolios.

Taking a look at the markets and our investment strategies, September’s significant market decline hit many asset classes and market indices. The S&P 500 Index declined nearly 5% in September and the declines have continued thus far into October. Lower quality “value stocks” declined less than faster growth companies, many of which we own, in September, breaking with multi decade trends at least for the moment. In our view, given the market moves we’ve seen in 2021, especially over the last few months, lower quality businesses deemed “value stocks” appear to have much less long-term upside than the higher quality, higher growth and profit businesses in areas of emerging or dominant technologies. In fact, this current market decline is providing a great buying opportunity for some fantastic businesses that are leading the market and economy in many different areas including digital transformation, cybersecurity, artificial intelligence, robotics and automation, and the work from anywhere trends.

Looking forward, with much of the global stock markets in a bear market trend and even bond markets in the negative for the year, investors are looking for direction. Given that the economy is growing well, unemployment is low for modern times, the trade war continues to recede and unpopular tax increases seem unlikely to come to fruition, markets seem more likely to rebound at some point soon rather than descend further. Markets are unpredictable, but the businesses we invest in tend to be very predictable with recurring revenue models that offer products and services customers are unlikely to “turn off”. Recent history supports this view. For example, during September and October 2020, the S&P 500 Index recorded a nearly 10% market correction. Our proprietary equity strategies then went on to gain nearly 20% in November and December 2020 combined. We could see a similar jump again this time given the extremely high quality of the businesses we own, but of course only time will tell.

STOCK HIGHLIGHTS

Company: Crowdstrike

Industries: Cybersecurity

Portfolio: Blended and U.S. Equity

Current Price: $239 1-Year Target: $315

Company Overview – Crowdstrike provides cyber security software for endpoint and cloud workload protection all over the world. Crowdstrike’s subscription based service has become a necessity for its customers. The recurring revenue model where customers can’t or won’t turn the service off, has provided significant growth and high profitability for the company.

Financial Highlights – We first invested in Crowdstrike stock in November 2020 at prices between $121 and $123 pershare. Since then the shares have gained about 200% because the company’s revenue growth rate has sustained 60% to 80% rates and the company touts gross profit margins of about 75%. Although the company is still young, they are a dominant player in the ever-growing cybersecurity industry, they have best in class software and profitability. We expect Crowdstrike to continue growing at high, sustainable rates for the foreseeable future.

Investment Thesis - We last wrote about Crowdstrike in January of this year, the stock had already provided our clients’ with significant gains and those gains have continued. Crowdstrike operates in a relatively new industry that is growing at a phenomenal pace as businesses and institutions realize that cybersecurity is a must for everyone. Cyber threats will only increase over time and Crowdstrike’s dominant software protect against threats of all kinds. The company’s industry leading software, revenue growth rate and profitability metrics stand out above all the competition.

Company: Docusign, Inc.

Industries: E-Signature & Digital Documents

Portfolio: Blended and U.S. Equity

Current Price: $247 1-Year Target: $325

Company Overview – Docusign provides cloud based e-signature and document preparation software. The company’s software automates workflows across the entire agreement process, uses artificial intelligence to search and analyze documents. Their form software is the dominant player in this industry with no second place even close. The company has a global reach with a massive and diverse customer base, but they are a U.S. company based in San Francisco, CA.

Financial Highlights – Docusign has only been a public company since the Summer of 2018, but has already grown to a market capitalization of $51 billion. The company produced nearly $1.8 billion in revenues in the last year and is proving to be extremely profitable. With gross profit margins near 80% and free cash flow margins of nearly 40%, Docusign could become one of the most profitable businesses in the world as far as net profits on each dollar of sales. Wall Street analyst consensus is that Docusign will continue growing at a rapid pace for many years as their dominance in the e-signature and e-document industry grows as does the industry as a whole. Analysts think Docusign will grow revenues at between 30% and 40% per year for at least the next 3 years and this should drive returns for shareholders.

Investment Thesis – We are invested in Docusign for many reasons and with our proprietary stock selection process, Docusign checks all the qualitative and quantitative boxes. Docusign meets our strict ESG (Environmental, Social, Governance) criteria and helps reduce paper waste. Docusign is a high growth company with extremely high profitability metrics. The company provides a service that, once adopted by businesses and institutions, because a critical element of business infrastructure. This means once Docusign lands a customer, that customer is very unlikely to cancel the service and evidence shows that customers usually spend more on the software with more user licenses. With their “sticky ecosystem” and recurring revenue model, Docusign provides investors with a recession resistant and predictable business. We expect to own Docusign shares for a very long time.

Disclaimer/Disclosure

The purpose of this newsletter is to explain what is happening with our investment strategies and our current views on the markets. We do not sell our investment report and it is intended only as a communication device. The information in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance or guarantee that the securities discussed herein will remain in an account’s portfolio at the time this report is received. The securities discussed do not represent an account’s entire portfolio and may only represent a small percentage of an account’s portfolio. It should not be assumed that any of the securities discussed were or will prove to be profitable, or that the investment recommendations or decisions ECM makes in the future will be profitable or will equal the investment performance of the securities discussed herein.

ECM uses certain proprietary databases, formulas and devices in its investment decision process. The use of these devices does not change the possibility of loss inherent in all investment decisions.

Contact Us

For questions regarding fees, risks, or other questions, please visit our website at www.ebertcapital.com or contact us directly and we will be happy to assist you.

Ebert Capital Management Inc.

530 F Street

Eureka, CA 95501

Telephone: (707) 407-3813

Toll-free Fax: (855) 407-3815

Email: info@ebertcapital.com

Performance

Our U.S. Equity strategy invests in U.S. companies with significant competitive advantages, barriers to entry, preferably a recurring revenue model, and tends to perform well during market selloffs. We only select the most dominant companies in their field. The desired holding period is long term, hopefully perpetually. This strategy consists of U.S. stocks only and is benchmarked to the S&P 500 Index. The U.S. Equity Strategy consists of all accounts that hold U.S. stocks of any market capitalization above $50 million. The composite creation date is 10/01/2019.

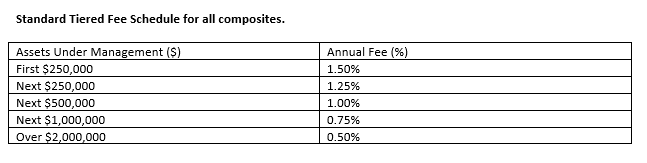

Returns are presented net and gross of actual management fees paid. Fees are described on the last page of this report and apply to all composites managed by Ebert Capital Management Inc. ECM’s account inclusion policy is the first full month or the end of the month in which the account is fully invested. The composite contains both taxable and nontaxable accounts. The returns of the individual portfolios within the composite are time-weighted, use trade date accounting, are based upon monthly portfolio valuations, and include the reinvestment of all earnings as of the payment date. The composite returns are asset-weighted based upon the beginning period market values calculated in U.S. dollars. Three-year ex post standard deviation for composite and benchmark is not present if 36 monthly returns are unavailable. A dispersion measure is not shown when there are five or fewer accounts in the composite for the entire year. The internal dispersion is calculated using the asset-weighted standard deviation of annual net returns of those portfolios that were included in the composite. The composite contained fewer than 1% of non-fee paying accounts at the end of each year.

Ebert Capital Management Inc. (ECM) is an independent, fee-only registered investment adviser. Ebert Capital Management claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Ebert Capital Management has been independently verified for the periods Dec 1, 2010 through December 31, 2013. The verification report is available upon request. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. Verification does not provide assurance on the accuracy of any specific performance report. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Policies for valuing portfolios, calculating performance, preparing GIPS Reports, and a list of composite descriptions are available upon request.

Past performance does not guarantee future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Past performance of markets, strategies, composites, or any individual securities is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s portfolio. Investment in the above referenced model composite is subject to investment risks, including, without limitation: market risk, interest rate risk, management style risk, business risk, sector risk, and other risks related to equity securities. There are no assurances that a portfolio will match or outperform any particular benchmark. Historical performance results for benchmarks, such as investment indices and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, which would have the effect of decreasing historical performance results.

Our Global Equity strategy invests in companies with at least 50% of revenues outside the U.S. or significant operations outside the U.S. The strategy invests in companies with significant competitive advantages, barriers to entry, preferably a recurring revenue model, and tends to perform well during market selloffs. We only select the most dominant companies in their field. The desired holding period is long term, hopefully perpetually. This strategy consists of U.S. Stocks with revenues of 50% or greater coming from outside the U.S. or significant operations outside the U.S. and non-U.S. stocks and is benchmarked to the MSCI ACWI (All Country World) Index. The composite creation date is 10/01/2019.

Returns are presented net and gross of actual management fees paid. Fees are described on the last page of this report and apply to all composites managed by Ebert Capital Management Inc. ECM’s account inclusion policy is the first full month or the end of the month in which the account is fully invested. The composite contains both taxable and nontaxable accounts. The returns of the individual portfolios within the composite are time-weighted, use trade date accounting, are based upon monthly portfolio valuations, and include the reinvestment of all earnings as of the payment date. The composite returns are asset-weighted based upon the beginning period market values calculated in U.S. dollars. The composite contained fewer than 1% of non-fee paying accounts at the end of each year.

Ebert Capital Management Inc. (ECM) is an independent, fee-only registered investment adviser. Ebert Capital Management claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Ebert Capital Management has been independently verified for the periods Dec 1, 2010 through December 31, 2013. The verification report is available upon request. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. Verification does not provide assurance on the accuracy of any specific performance report.

GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Policies for valuing portfolios, calculating performance, preparing GIPS Reports, and a list of composite descriptions are available upon request.

Past performance does not guarantee future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Past performance of markets, strategies, composites, or any individual securities is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s portfolio. Investment in the above referenced model composite is subject to investment risks, including, without limitation: market risk, interest rate risk, management style risk, business risk, sector risk, and other risks related to equity securities. There are no assurances that a portfolio will match or outperform any particular benchmark. Historical performance results for benchmarks, such as investment indices and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, which would have the effect of decreasing historical performance results.

Our Blended Equity Strategy is composed of a mix of our U.S. Equity investments and our Global Equity investments. The purpose of this strategy is to hold stocks of high quality companies that maintain significant competitive advantages over their peers, barriers to entry, preferably with a recurring revenue model, and tends to perform well during market downturns. We only select the most dominant companies in their field. The desired holding period is long term, hopefully perpetually. The strategy is benchmarked to the MSCI ACWI. The composite creation date is 10/01/2019.

Returns are presented net and gross of actual management fees paid. Fees are described on the last page of this report and apply to all composites managed by Ebert Capital Management Inc. ECM’s account inclusion policy is the first full month or the end of the month in which the account is fully invested. The composite contains both taxable and nontaxable accounts. The returns of the individual portfolios within the composite are time-weighted, use trade date accounting, are based upon monthly portfolio valuations, and include the reinvestment of all earnings as of the payment date. The composite returns are asset-weighted based upon the beginning period market values calculated in U.S. dollars. The composite contained fewer than 1% of non-fee paying accounts at the end of each year.

Ebert Capital Management Inc. (ECM) is an independent, fee-only registered investment adviser. Ebert Capital Management claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Ebert Capital Management has been independently verified for the periods Dec 1, 2010 through December 31, 2013. The verification report is available upon request. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. Verification does not provide assurance on the accuracy of any specific performance report.

GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Policies for valuing portfolios, calculating performance, preparing GIPS Reports, and a list of composite descriptions are available upon request.

Past performance does not guarantee future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Past performance of markets, strategies, composites, or any individual securities is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s portfolio. Investment in the above referenced model composite is subject to investment risks, including, without limitation: market risk, interest rate risk, management style risk, business risk, sector risk, and other risks related to equity securities. There are no assurances that a portfolio will match or outperform any particular benchmark. Historical performance results for benchmarks, such as investment indices and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, which would have the effect of decreasing historical performance results.

The Conservative Income Strategy consists of all accounts that hold bond ETFs selected with the aim of providing principal protection and income using low-cost bond index ETFs of varying maturity and bond quality and a small allocation to stocks. The composite creation date is 8/1/2011.

Returns are presented net and gross of actual management fees paid. Fees are described on the last page of this report and apply to all composites managed by Ebert Capital Management Inc. ECM’s account inclusion policy is the first full month or the end of the month in which the account is fully invested. The composite contains both taxable and nontaxable accounts. The returns of the individual portfolios within the composite are time-weighted, use trade date accounting, are based upon monthly portfolio valuations, and include the reinvestment of all earnings as of the payment date. The composite returns are asset-weighted based upon the beginning period market values calculated in U.S. dollars. The Benchmark for the composite is the Barclays Capital U.S. Aggregate Bond Index, presented in U.S. dollars. The composite contained fewer than 1% of non-fee paying accounts at the end of each year.

Ebert Capital Management Inc. (ECM) is an independent, fee-only registered investment adviser. Ebert Capital Management claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Ebert Capital Management has been independently verified for the periods Dec 1, 2010 through December 31, 2013. The verification report is available upon request. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. Verification does not provide assurance on the accuracy of any specific performance report.

GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Policies for valuing portfolios, calculating performance, preparing GIPS Reports, and a list of composite descriptions are available upon request.

Past performance does not guarantee future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Past performance of markets, strategies, composites, or any individual securities is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s portfolio. Investment in the above referenced model composite is subject to investment risks, including, without limitation: market risk, interest rate risk, management style risk, business risk, sector risk, and other risks related to equity securities. There are no assurances that a portfolio will match or outperform any particular benchmark. Historical performance results for benchmarks, such as investment indices and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, which would have the effect of decreasing historical performance results.