October 2023

INVESTMENT OVERVIEW

During the 3rd quarter global stock markets experienced moderate declines, with U.S. stocks also experiencing a moderate decline from the July highs, but bond markets unfortunately continued to experience a steep drop. The bond bear market is now in its 4th year as the record pace of interest rate hikes by the Federal Reserve has continued to worsen what’s become the worst bond market crash ever. Other themes that dominated Q2 continued to affect the market psychology in Q3 and that includes continued worries about rising interest rates and Congressional dysfunction and excitement about progress happening in the fields of artificial intelligence and cybersecurity.

During the 3rd quarter the S&P 500 Index declined 3.65%, the Nasdaq 100 Index declined 3.06% and the iShares All Country World Index fund, which represents the global stock market, declined, 4.34%. These moderate declines in stocks in Q3 compare favorably again to the bond market, as evidenced by a 9.37% decline in the Vanguard Long-Term Bond ETF and a 13.04% decline in the iShares 20+ Year Treasury Bond ETF as interest rates raced higher.

Despite the declines in stocks in Q3, for our clients, 2023 has continued to be an outstanding year for our investment strategies. At the beginning of the year, coming off the worst year ever for market value declines in mega cap tech stocks, many investors and professionals had turned away from historically unique businesses like Nvidia, Microsoft, Amazon, and many other tech companies. It’s well known that most of the market’s returns for over 2 decades have come from unique business models like this and others with a “monopolistic” presence in their industries, but the 2022 crash scarred even the most seasoned investors. We remained bullish on what we consider to be the best business models and we did not reduce allocations to these great businesses simply because the stock price action in 2022 didn’t reflect the future growth and profitability in these great companies. So, many investors missed out on the first half rally in stocks like Nvidia and Amazon, only to try and buy in later because of sudden FOMO – Fear of Missing Out. For 2023 though, our equity strategies are outperforming the rest of the stock market by a wide margin.

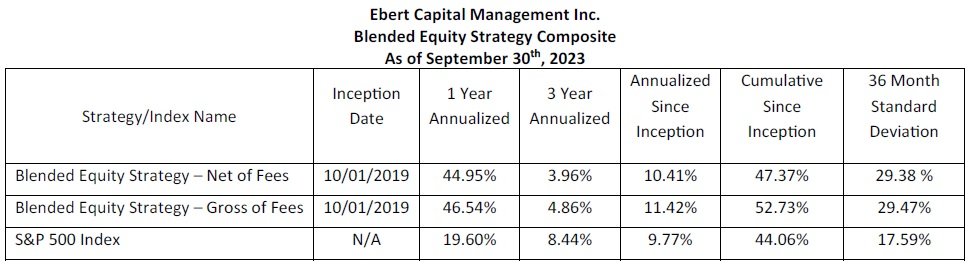

Year-to-date our Global Equity strategy has risen 49.24%, our Blended Equity strategy has gained 50.49%, our U.S. Equity strategy has gained 35.39% and our Diversified Growth and Conservative Growth strategies have also shown strong performance with gains of 24.35% and 15.48%, respectively. The S&P 500 Index has gained 11.69% and the Dow Jones Industrial Average has gained just 5.47%, underperforming the Nasdaq Index by a substantial margin. The huge outperformance by our strategies this year is mostly due to big rebounds in the stock prices of tech platform leaders and dominant monopolistic companies like Visa and Mastercard. Our Conservative Income strategy has gained 3.52% this year and that is largely because of asset allocation changes we’ve made over the last couple years to reduce direct exposure to bond funds, which have experienced massive declines, in favor of low volatility equity ETFs with strong dividends. More on these changes are discussed below.

Many of our best performing stocks this year are superstar companies in the fields of AI and cybersecurity. The companies leading these fast-growing industries are extremely profitable, growing their dominance and improving their technology at an extremely fast pace. AI is not just an enduring theme but will likely become a bedrock component of the U.S. economy and stock market….and very quickly. AI is already becoming knitted into our daily lives and the leaders in this ever-expanding field will potentially produce outstanding shareholder returns going forward. Likewise, game changing cybersecurity events like the massive hacks experienced by MGM and Caesars make it clear that the importance and necessity of cybersecurity in an increasingly online world will continue to increase at an extremely fast pace. In the case of the MGM & Caesars hacks, hackers extorted millions of dollars and many of the day-to-day operations at both companies were nonfunctional until the hackers received the ransoms. According to cybersecurity experts at Okta, Crowdstrike, Palo Alto Networks and Microsoft, Reuters reported that young hackers have found social engineering to be the best way to get around strong cybersecurity. These events make it clear how much of a necessity cybersecurity of all kinds is to businesses, which is a sad indictment of modern life, but also makes it clear that the best cybersecurity companies have services their customers can’t live without.

We would consider the groundswell of notoriety about the advancements in AI and cybersecurity to be tightly tied together in some instances, but for very different reasons. AI might be the biggest technological advancement since the rise of the “modern” internet in the 1990s. There are unknowable opportunities and challenges ahead and companies are literally racing to get ahead of competition. The leaders and first movers are already showing that getting ahead in AI can lead to immediate profits. On the other hand, with cybersecurity, where all businesses are now vulnerable, companies are racing to get ahead of hackers, sign on with the top cybersecurity vendors simply to avoid a calamity such as a ransomware attack. We expect to hold significant positions in the leaders in these industries for many years to come. And the leaders in cybersecurity are using AI to improve their platforms while hackers are using AI to exploit weaknesses.

Back to the bond market, the reason for the declines is the basic math of rising interest rates causing declines in a market where most bonds outstanding were issued during times when interest rates were very low. Since interest rates were extremely low for about the longest period in U.S. history, most bonds issued over the last 15 years were issued with very unattractive yields. So as interest rates rise dramatically, the fair market value of those bonds decline equally as dramatically. We’ve discussed this topic before, but it’s worth noting that the Federal Reserve’s historic interest rate increases and quantitative tightening have caused a bond bear market so bad, that there are virtually no bond funds in the world that have produced positive returns going back at least 10 years. In fact, the bond market is so bad that other than the meager yields produced by bond funds over the last 20+ years, almost all bond funds have had no price appreciation gains going back over 30 years. So, bond funds have not provided the downside protection that individual bonds do and we have increasingly found bond funds less attractive for most investors, even for investors seeking yield and low volatility.

Holders of individual treasury bonds for instance, don’t have any chance of losing principal if they hold that bond until maturity. Bond fund holders, however, own hundreds or thousands of bonds trading at fair market value, based on initial interest rate applied to that bond when it was issued, the time remaining until maturity and current interest rates. So, we are finding very attractive individual bonds, and CDs, for investors now that interest rates are higher. But bond funds, such as the Vanguard Long-Term Bond ETF for example, will likely take 10 to 15 years to recover to previous 2020 levels. So, as we have all year, for many of our clients we are pulling away from bond funds and using the proceeds to invest in a mix of low volatility dividend paying equity ETFs and extremely high-quality dividend paying stocks.

Overview: Shopify is a global e-commerce operating system with a set of tools and capabilities that enable merchants of all sizes to sell products and services online. Shopify acts as the back and front end, online, for merchants and provides businesses of all sizes a suite of services that allows Shopify to be a one stop shop for e-commerce, web design and hosting, merchant/payments solutions, logistics, online marketing, data collection and more. Shopify is often unknown and unseen by the front-end consumer, but it’s huge ecosystem allows businesses to run their entire business on Shopify’s platform and the company has no true competitor in providing this ecosystem to businesses.

Financial Highlights: Shopify has been growing rapidly ever since its inception. In 2013 the company posted $50 million in sales but just 10 years later the annual revenues are $6.30 billion. This amounts to an outstanding compounded annual growth rate of 62.53% over the past decade. According to seekingalpha.com, Shopify is expected to grow earnings at a rate of over 50% per year for the next 5 years. Shopify has also recently sold one part of its logistics business to Flexport, a tech-driven logistics business, which has immediately helped increase the company’s profitability. Shopify hopes to continue growing and improving profitability and Wall Street analysts expect profitability to surge in the next several years.

Investment Thesis: We invested in Shopify due to the company’s dominance in its industry, the rapid growth of earnings and revenues, and the strategic positioning that has led the company to achieve this level of success. This company clearly has a durable competitive advantage in its unique business, currently has no true direct competitors and it has become a dominant player in the fast-growing fields of e-commerce and SMB merchant solutions. Going forward Shopify’s pricing power will likely increase, helping margins and the company’s ecosystem and AI/data advantages should solidify its position as a platform that businesses cannot function without.

Overview: Cyber-attacks have become increasingly common and dangerous for businesses, with attacks being used to exploit companies’ technology to gain access and data for ransom. MGM Studios, Caesars Entertainment and Clorox were recently the victims of cyber attacks that led to serious business disruptions and huge ransoms. Clorox recently stated that their quarterly revenues were going to drop a whopping 25%, directly resulting from a cyber-attack. Businesses are increasingly understanding that spending on cybersecurity is a must and this non-discretionary spending and the massive growth in the field are extremely beneficial to Crowdstrike, which is well known to a dominant player in the cybersecurity field.

Financial Highlights: Crowdstrike has experienced a meteoric surge in revenues over the past 7 years, achieving $2.6 billion in annual revenues in the most recent year after finishing 2017 with just $53 million in revenues. CrowdStrike’s profitability metrics also suggest the company is well on its way to building a huge moat and it’s clearly a cybersecurity platform with a durable competitive advantage over direct peers, despite competition being fierce in the industry. CrowdStrike’s 74% gross margins and free cash flow margins of 33% suggest that after the growth phase is over, which is years away, the company could remain extremely profitable. The company has successfully transitioned from a high growth to a high profit engine during this period where interest rates have soared. The company expects to achieve over $10 billion in annual recurring revenue by 2030 and sustained free cash flow yields above 30%.

Investment Thesis: Crowdstrike is the global leader in endpoint-to-endpoint cybersecurity protection and an early adopter of artificial intelligence. The company is cloud agnostic, and its Falcon platform is widely understood to be the best of its kind in the industry. The company is based in Austin, Texas but serves a global client base and CEO George Kurz has proven to not only lead a technology leader, but also already has proven to be a shareholder friendly CEO focused on increasing profits and should lead to stock buybacks and reduced share-based compensation in the future.

Disclaimer/Disclosure

The purpose of this newsletter is to explain what is happening with our investment strategies and our current views on the markets. We do not sell our investment report and it is intended only as a communication device. The information in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance or guarantee that the securities discussed herein will remain in an account’s portfolio at the time this report is received. The securities discussed do not represent an account’s entire portfolio and may only represent a small percentage of an account’s portfolio. It should not be assumed that any of the securities discussed were or will prove to be profitable, or that the investment recommendations or decisions ECM makes in the future will be profitable or will equal the investment performance of the securities discussed herein.

ECM uses certain proprietary databases, formulas and devices in its investment decision process. The use of these devices does not change the possibility of loss inherent in all investment decisions.

Contact Us

For questions regarding fees, risks, or other questions, please visit our website at www.ebertcapital.com or contact us directly and we will be happy to assist you.

Ebert Capital Management Inc.

530 F Street

Eureka, CA 95501

Telephone: (707) 407-3813

Toll-free Fax: (855) 407-3815

Email: info@ebertcapital.com

Our Diversified Growth strategy seeks to achieve growth from investing in diversified equity ETFs with exposure to the Nasdaq innovators, the software industry and emerging technologies. The desired holding period is long term. The composite creation date is 01/01/2017. Returns are presented net and gross of actual management fees paid. Fees are described on the last page of this report and apply to all composites managed by Ebert Capital Management Inc. ECM’s account inclusion policy is the first full month or the end of the month in which the account is fully invested. The composite contains both taxable and nontaxable accounts. The returns of the individual portfolios within the composite are time-weighted, use trade date accounting, are based upon monthly portfolio valuations, and include partially backtested data. The composite returns are asset-weighted based upon the beginning period market values calculated in U.S. dollars. The composite contained fewer than 1% of non fee-paying accounts at the end of each year. The performance presented from 01/01/2017 through 12/31/2021 is backtested performance of a model portfolio with the same securities allocations as found in actual client accounts and ECM’s management fee was imputed at the highest level of our fee schedule, 1.5% annually, during this period. The performance results from 01/01/2017 through 12/31/2021 are hypothetical and not based on the performance of actual client accounts. Backtests were performed at portfoliovisualizer.com.

Our Conservative Growth strategy seeks to achieve growth with reduced volatility from investing a mix of equity and fixed income ETFs. The equity ETFs tilt towards sectors with exposure to emerging technologies and the fixed income part of the portfolio focuses on income and low volatility. The desired holding period is long term. The composite creation date is 01/01/2017. Returns are presented net and gross of actual management fees paid. Fees are described on the last page of this report and apply to all composites managed by Ebert Capital Management Inc. ECM’s account inclusion policy is the first full month or the end of the month in which the account is fully invested. The composite contains both taxable and nontaxable accounts. The returns of the individual portfolios within the composite are time-weighted, use trade date accounting, are based upon monthly portfolio valuations, and include partially backtested data. The composite returns are asset-weighted based upon the beginning period market values calculated in U.S. dollars. The composite contained fewer than 1% of non fee-paying accounts at the end of each year. The performance presented from 01/01/2017 through 12/31/2021 is backtested performance of a model portfolio with the same securities allocations as found in actual client accounts and ECM’s management fee was imputed at the highest level of our fee schedule, 1.5% annually, during this period. The performance results from 01/01/2017 through 12/31/2021 are hypothetical and not based on the performance of actual client accounts. Backtests were performed at portfoliovisualizer.com.

Our Blended Equity Strategy is composed of a mix of stocks and ETFs from our other investment strategies. The purpose of this strategy is to hold our firm’s most favored holdings from all our investment strategies. The desired holding period is long term, hopefully perpetually. The strategy is benchmarked to the S&P 500 Index. The composite creation date is 10/01/2019. Returns are presented net and gross of actual management fees paid. Fees are described on the last page of this report and apply to all composites managed by Ebert Capital Management Inc. ECM’s account inclusion policy is the first full month or the end of the month in which the account is fully invested. The composite contains both taxable and nontaxable accounts. The returns of the individual portfolios within the composite are time-weighted, use trade date accounting, are based upon monthly portfolio valuations, and include the reinvestment of all earnings as of the payment date. The composite returns are asset-weighted based upon the beginning period market values calculated in U.S. dollars. The composite contained fewer than 1% of non fee-paying accounts at the end of each year.

Our Global Equity strategy invests in companies with at least 50% of revenues outside the U.S. or significant operations outside the U.S. The desired holding period is long term. This strategy is benchmarked to the S&P 500 Index. The composite creation date is 10/01/2019. Returns are presented net and gross of actual management fees paid. Fees are described on the last page of this report and apply to all composites managed by Ebert Capital Management Inc. ECM’s account inclusion policy is the first full month or the end of the month in which the account is fully invested. The composite contains both taxable and nontaxable accounts. The returns of the individual portfolios within the composite are time-weighted, use trade date accounting, are based upon monthly portfolio valuations, and include the reinvestment of all earnings as of the payment date. The composite returns are asset-weighted based upon the beginning period market values calculated in U.S. dollars. The composite contained fewer than 1% of non fee-paying accounts at the end of each year.

Our U.S. Equity strategy invests in U.S. companies or companies with a majority of operations and revenues coming from the U.S. The desired holding period is long term. This strategy is benchmarked to the S&P 500 Index. The composite creation date is 10/01/2019. Returns are presented net and gross of actual management fees paid. Fees are described on the last page of this report and apply to all composites managed by Ebert Capital Management Inc. ECM’s account inclusion policy is the first full month or the end of the month in which the account is fully invested. The composite contains both taxable and nontaxable accounts. The returns of the individual portfolios within the composite are time-weighted, use trade date accounting, are based upon monthly portfolio valuations, and include the reinvestment of all earnings as of the payment date. The composite returns are asset-weighted based upon the beginning period market values calculated in U.S. dollars. Three-year ex post standard deviation for composite and benchmark is not present if 36 monthly returns are unavailable. A dispersion measure is not shown when there are five or fewer accounts in the composite for the entire year. The internal dispersion is calculated using the asset-weighted standard deviation of annual net returns of those portfolios that were included in the composite. The composite contained fewer than 1% of non fee-paying accounts at the end of each year.

The Conservative Income Strategy consists of all accounts that hold bond ETFs selected with the aim of providing principal protection and income using low-cost bond index ETFs of varying maturity and bond quality and a small allocation to stocks. The strategy is benchmarked to the Barclays Capital U.S. Aggregate Bond Index. The composite creation date is 8/1/2011. Returns are presented net and gross of actual management fees paid. Fees are described on the last page of this report and apply to all composites managed by Ebert Capital Management Inc. ECM’s account inclusion policy is the first full month or the end of the month in which the account is fully invested. The composite contains both taxable and nontaxable accounts. The returns of the individual portfolios within the composite are time-weighted, use trade date accounting, are based upon monthly portfolio valuations, and include the reinvestment of all earnings as of the payment date. The composite returns are asset-weighted based upon the beginning period market values calculated in U.S. dollars. The Benchmark for the composite is the Barclays Capital U.S. Aggregate Bond Index, presented in U.S. dollars. The composite contained fewer than 1% of non fee-paying accounts at the end of each year.

Ebert Capital Management Inc. (ECM) is an independent, fee-only registered investment adviser. Ebert Capital Management claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Ebert Capital Management has been independently verified for the periods Dec 1, 2010 through December 31, 2019. The verification report is available upon request. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. Verification does not provide assurance on the accuracy of any specific performance report.

GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Policies for valuing portfolios, calculating performance, preparing GIPS Reports, and a list of composite descriptions are available upon request.

Past performance does not guarantee future results. Performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted. Past performance of markets, strategies, composites, or any individual securities is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s portfolio. Investment in the above referenced model composite is subject to investment risks, including, without limitation: market risk, interest rate risk, management style risk, business risk, sector risk, and other risks related to equity securities. There are no assurances that a portfolio will match or outperform any particular benchmark. Historical performance results for benchmarks, such as investment indices and/or categories, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, which would have the effect of decreasing historical performance results.